JSMedia – With its Platinum Rewards Program, Rogers Bank allows you to earn unlimited cash back on purchases. This card is available for everyday purchases and for big ticket purchases. With the added benefit of applying your rewards to your Rogers, Fido, or Chatr bill, you can easily earn and redeem your points for free money. You can also access your account via the bank’s app, and the service is free of charge. To learn more about the Platinum Rewards Program and other benefits of the Card, continue reading.

As a Rogers Bank customer, you can earn Rewards on purchases you make with your MasterCard. You will also earn rewards through Rogers Bank’s loyalty program. Although these are not actual cashback, the rewards will help you build a strong financial future. These points can be redeemed for gift cards and can even be used as cashback. You can also redeem your points on the MasterCard Pay with Rewards card, and you can use them towards your next purchase.

You can also earn cash back through a Rogers Bank credit card. The company offers 1.75% cash back on all purchases and 2% on Rogers products and services. Foreign currency purchases will earn you 4% interest. You can also use your MasterCard to shop at participating stores online. After you’ve earned $25 in cash back, you can use it at the store and in the app. After you redeem your points, you can choose to receive the cash back as a credit on your MasterCard.

Rogers Bank Credit Card, How to Get the Lowest Rates on a Home Mortgage

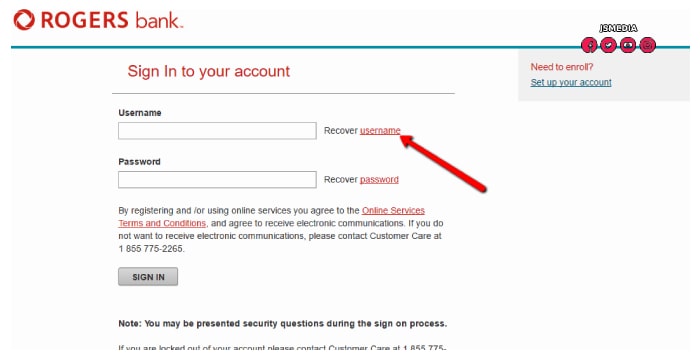

The best way to manage your account at Rogers Bank is through the app. With the Mobile Wallet, you can manage your balance and manage your Rogers Mastercard. It also comes with a MasterCard that earns unlimited cash back, and can be used anywhere Mastercard is accepted. The card has maximum security with automatic fraud prevention, personalized alerts, travel insurance, and optional group balance protection. This card is available for individuals and small businesses alike, and you can also request this benefit when applying for a new credit card.

Rogers Bank offers three types of credit cards. The Fido Mastercard is designed for mobile devices and telecom bills, while the Rogers Platinum Mastercard is best for high-end purchases. With the Fido Mastercard, you can earn bonus cash back every time you use your card. You can redeem the bonus cash back as soon as you use it. The Fido Platinum Mastercard is the best choice if you are traveling to the U.S.

The Rogers Platinum Mastercard is available in different currencies. For example, the World Elite card gives you 4% cash back on all foreign purchases, while the other two cards offer you 3% cash back. All three cards have zero annual fees. The 1% cash back you earn is redeemable for any other currency. You can also use your card to make payments online or in stores. If you want to get an extra boost from your credit card, you can sign up for the Rogers Platinum Mastercard.

The Platinum Mastercard has an annual fee, but you can get no fees if you use the MasterCard with Rogers Bank. The World Elite Mastercard comes with an accelerated earn rate on U.S. dollar purchases, and offers valuable perks for travelers. The cashback earned from the card is worth $1 in every purchase. Moreover, the Platinum Mastercard has travel insurance as well. You can use this card for travel and for other expenses.

While its Platinum Mastercard has no annual fee, it has great rewards program. If you want to enjoy unlimited benefits, get the Rogers World Elite Mastercard. The no-fee card has competitive rewards and perks. It requires a minimum income, which is approximately $80,000 for individuals and $150,000 for households. The Platinum Mastercard has protection against unauthorized POS debit transactions, mobile phone bills, and counterfeit fraud. You can also avail of Rogers World Elite Visa and MasterCard.

The Platinum Mastercard is one of the most popular cards from Rogers Bank. This card offers you perks such as zero liability coverage and a ten-day international travel insurance benefit. The other card offers similar benefits to Platinum and Fido Mastercard. The Gold Mastercard is the best choice for business travelers. Aside from offering excellent benefits, the Platinum Mastercard is also a great choice for those who want to travel a lot.