JSMedia – The Exchange Bank of Canada is a new Canadian Schedule 1 Bank that provides specialized wholesale foreign exchange solutions. Its services include international wire transfers, the sale of foreign bank drafts, and foreign cheque clearing in the Canadian market. Currency Express is a wholly owned subsidiary of the Exchange, the leading US-based foreign exchange provider in North America. The company was established in 2016, and is a publicly traded company in Toronto. As of June 30, 2020, it had a total asset base of $72 million.

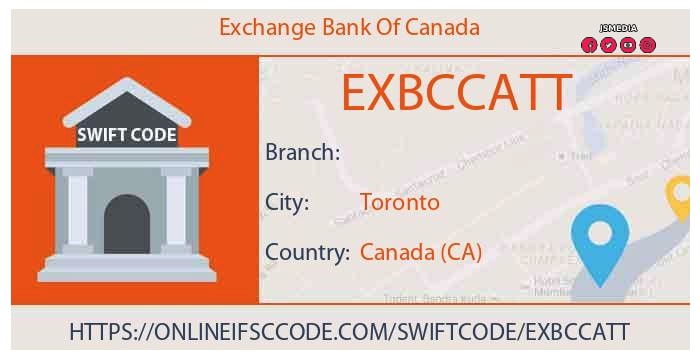

The Bank is headquartered in Toronto and is one of Canada’s largest foreign currency exchange providers. It offers a broad range of foreign currency exchange products and services, including foreign cheque clearing, international wire transfers, and the issuance of foreign bank drafts. The company uses the EBCFX software to process transactions. The Exchange does not make deposits or loans. However, the company does accept payments in Canadian dollars, US dollars, and other currencies.

In addition to its retail and wholesale foreign exchange services, the Bank of Canada also offers services for large corporations and financial institutions. Its foreign exchange technology and services will allow it to meet the Federal Reserve’s international cash services program. These offerings are designed to help Canadian companies obtain credit, and a larger bank could provide more funds. With this, the Bank of Canada will have the ability to facilitate international trade and payments, as well as meet their lending objectives.

What Is the Exchange Bank of Canada? Here The Explanation

The Board was chartered in 1934, with the Canadian Bank Note Company holding the contract to produce banknotes since 1935. Initially, this company was a wholly owned corporation, but it later became an independent corporation. It was established as an institution to avoid political influence. Moreover, the Act specifies that the organization must be privately-owned in order to avoid partisan politics. It also has the capability to manage large-denomination dollar notes.

Before the creation of the Bank of Canada, the Bank of Montreal had been the largest bank in Canada. It was the government’s banker. The central bank also had the responsibility to print Canadian banknotes. In addition to printing currency, the ExchangeBank ofCanada was also responsible for establishing a national currency. The federal Department of Finance is the primary authority in terms of printing the Canadian dollar. Its role is to provide liquidity for the economy and to ensure that the exchange rate is stable and predictable.

As CEO of the Bank, Mr. Leonard will focus on emerging digital and fintech opportunities. He has over thirty years of experience in the banking industry. He was previously the CFO of the CFF Bank, which he helped grow to over $1 billion in assets and $245 million in loans under administration. Earlier, he founded ING DIRECT, which he grew to its current size of $1.2 billion. In addition to his professional experience, he holds a Bachelor of Commerce degree from the University of Western Ontario.

As the country’s largest financial institution, the Exchange Bank of Canada is a key player in the global finance industry. With a history of over 130 years, the Exchange Bank of Canada has always been an important player in the global economy. A regulated Canadian institution is mandated to provide its citizens with sound financial services and a strong currency. Further, the Exchange Bank of a small country is a world-class trading centre.

Bogie Ozdemar is a former member of the Ontario provincial legislature. He served as Minister of Finance and President of the Treasury Board. He also oversaw the creation of the Ontario Financial Services Regulatory Authority. Moreover, he has a 20-year career in commercial banking. He has a number of responsibilities as a Board member. He serves on the Human Resources and Governance committees of the bank. He is also a member of several foundations.

Shenglin is a Vice-Chairman of the Board and has served on the Board since its inception. He is the head of Shenglin Financial, one of the top insurance agents in London Life Insurance Company. Shenglin Xian also owns Shenglin Holding Co. Ltd., which operates in China and Canada. In addition, Shenglin Xian is the chairman of the Henan Association of Canada.