JSMedia – EQ Bank is an online bank that offers a savings and checking account. The EQ bank has no monthly fees and no minimum balance requirements. Besides this, you can transfer money to and from your account via e-Transfers. There is no limit on the number of transfers you can make per month, and you can send money internationally for free. You can open an account with EQ Bank today and start earning 1.25% interest today!

The EQ Bank US Dollar Account is one of the best ways to transact with US dollars. In addition to having a US dollar account, you can also transfer funds to other US dollar accounts internationally. EQ Bank partners with Wise, which makes it easy to transfer funds. Moreover, transfers from an EQ to a Canadian account are free. So, if you are looking for a new mortgage, EQ Bank is the place for you.

The EQ Bank online savings account requires a savings plus account. To access EQ Bank’s savings account, you must open an EQ Bank Savings Plus Account. You will receive micro-deposits every three months or so to verify your existing bank account. If you can’t wait that long, you can use the micro-deposits to fund your EQBank account. Once you do this, you will be able to access your account anytime you want. You can even transfer money internationally from your EQBank savings account to an account in your own name!

Is EQ Bank a Good Option For a Mortgage?

EQ Bank offers several banking products. You can open a savings or a GIC account with it. You’ll need to be a resident of Canada to sign up for an EQ Bank account. You can apply online for a free EQ bank membership by clicking on the “Join Now” button on the website. You may have to visit a Canada Post office if you already have an account with another bank. You don’t have to worry about losing your money. The EQ Bank is secure and your money is protected.

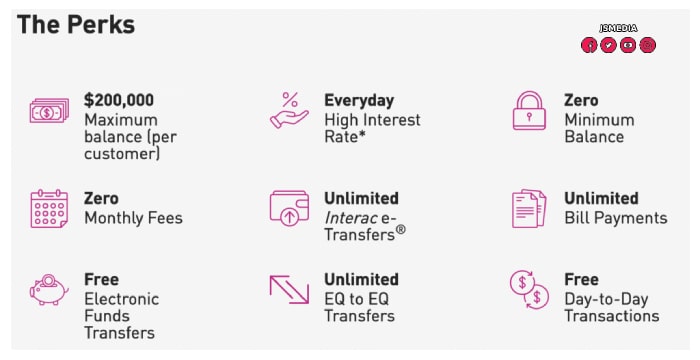

For savings and checking accounts, EQ Bank offers a zero-fee Savings Plus Account. This account features a 1% interest rate and is the most popular type of account with EQ Bank. Unlike many other banks, EQ Bank offers free online banking. Adding to this, a US Dollar Account with EQBank is an excellent choice for many people. It is compatible with a number of other popular financial services, including e-commerce.

EQ Bank offers competitive interest rates that are higher than most digital banks in Canada. The bank is backed by Equitable Bank, which has 50 years of experience in the industry. EQ Bank offers multiple layers of security and fraud monitoring to protect your funds and prevent identity theft. Your savings and credit card deposits are CDIC-insured and can be used at ATMs and online. In addition, EQ Bank has a savings account without a monthly fee, but no ATM withdrawal limits.

Another feature of EQ Bank is its joint accounts. These accounts can be opened by two or three people. A joint account can be great for elderly parents or grandparents who can’t manage their finances alone. Each person can earn interest from the account in their name and have access to funds. In addition to a separate account, EQ Bank also offers a bank account that offers the same benefits as a main account. There are no monthly fees, no minimum balance requirements, and no fees.

Despite its name, EQ Bank is a digital bank that launched in 2016. It is Canada’s first bank born in the mobile age, and it has transformed everyday banking. With the EQBank Savings Plus Account, Canadians can earn higher interest rates and move money easily. With over 185,000 customers, EQ has the potential to be the leading digital bank in Canada. There are many reasons to choose EQ as your new financial institution.

EQ Bank’s registered savings accounts work like any other registered product. They offer an interest rate of 1.25% until May 26, 2021, and a 1.35% interest rate thereafter. The EQ bank also offers an e-Transfer service, which will allow you to send money to family and friends overseas. The EQ bank’s website has a list of their services. In addition to these, the EQ bank offers a retirement savings plan that provides a competitive interest rate and is CDIC insured.