JSMedia – You can access B2B Bank‘s financial services online and through their mobile app. You can apply for investment or mortgage loans, or access banking services, such as account transfers. However, all mortgages are subject to credit approval and may vary. The variable interest rates are based on the prime rate at the time of application, and may change without notice. The B2B Bank Alternative Rate is a good choice for those looking to secure a low-interest loan.

The prime rate is the annual interest rate determined by B2B Bank. The reference rate is current as of March 31, 2020, and is subject to fluctuation. Therefore, you should not rely on this rate to make your decision on whether to apply for a mortgage or other financial product. Always consult with a licensed financial adviser for more information about the risks associated with a particular investment. A higher interest-rate does not necessarily mean a better deal, and your best bet may be to choose another bank.

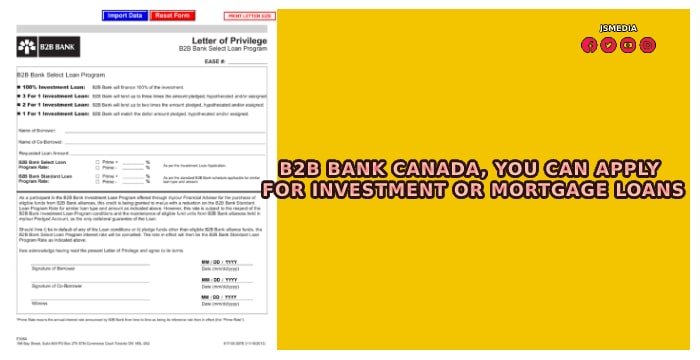

B2B Bank Canada, You Can Apply for Investment or Mortgage Loans

The B2B Bank Alternate Rate is based on an assessment of the strength of your application. While a minimum credit score may be required for approval, it is not a guarantee of maximum LTV and amortization options. Please note that the minimum credit score requirement for the B2B Bank Net Worth Program is different in different provinces. You may also have to provide additional documentation to access the Net Worth Program. These terms and conditions apply to all financial products provided by B2B Bank.

A comprehensive mortgage portfolio is available through B2B Bank. The Homeowner’s Kit is a single lending solution that combines a home equity line of credit and a mortgage. This innovative solution is a combined mortgage and home equity line of credit. All B2B Bank mortgages are backed by its exclusive broker-focused service model. These factors are the basis of its “B2B Bank advantage”. You should be able to find the best mortgage for your specific situation by applying online or through a local broker.

A B2B Bank investment loan is a long-term investment option. The bank will provide a trailer for a borrower to resell the investment to a client. It will also pay interest on a trailer when the customer chooses to finance the purchase. In addition, the new owner of a home must have a credit rating of at least 650. There are a variety of benefits to owning a home.

The B2B Bank’s financial services company has offices and subsidiaries in the United States, Canada, and the United Kingdom. They operate independently of a bank. While each of these companies has their own distinct characteristics and specialties, they do not provide investment advice. The primary services offered by B2B Bank include a mortgage broker, a trust, and a financial services company. These businesses provide financing solutions for various types of businesses.

You need to have two forms of identification with you at all times. Moreover, B2B bank requires an original signature. Besides, you will need to provide an EASE number. Your company’s identity information is vital to your business. If you need to open a dealer’s account, the corresponding document must be signed by the dealer. If you want to open a retail account, make sure to include the EASE number.

Payments through ACH are the most common payment method in the B2B world. They can be sent to any bank account and are free of charge. Some vendors prefer to use ACH instead of credit cards for their transactions. Other businesses, however, still use cash or plastic to pay for products. They can send payment through the ACH or by a letter of direction. Similarly, B2B payments are often a bit more complicated.

While B2B banks are trying to adapt to the changing payment landscape, the APIs are a key enabler of these new business models. Developing and using these APIs will allow businesses to take advantage of the benefits of this new technology. This means they should embrace innovation and look for ways to make their business more competitive. And if your APIs are ready to serve as a platform for partners and clients, then you’ll be well on your way.